4 Simple Techniques For Estate Planning Attorney

4 Simple Techniques For Estate Planning Attorney

Blog Article

Getting The Estate Planning Attorney To Work

Table of ContentsRumored Buzz on Estate Planning AttorneyAbout Estate Planning AttorneyThe Estate Planning Attorney StatementsSome Known Facts About Estate Planning Attorney.

Your lawyer will also assist you make your files authorities, preparing for witnesses and notary public signatures as needed, so you do not need to fret about attempting to do that last step on your own - Estate Planning Attorney. Last, yet not least, there is beneficial satisfaction in establishing a connection with an estate planning attorney that can be there for you later onBasically, estate planning lawyers give value in lots of methods, far beyond simply supplying you with printed wills, trust funds, or other estate planning papers. If you have questions regarding the procedure and wish to find out extra, contact our office today.

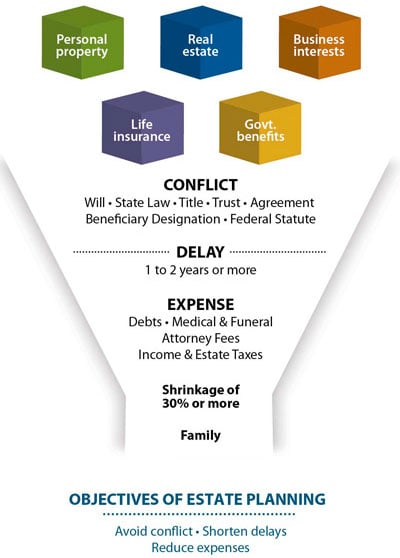

An estate preparation attorney helps you define end-of-life decisions and lawful papers. They can set up wills, establish trust funds, produce health treatment regulations, develop power of attorney, create sequence strategies, and much more, according to your desires. Collaborating with an estate preparation attorney to complete and oversee this lawful documentation can assist you in the following eight areas: Estate preparing lawyers are professionals in your state's trust fund, probate, and tax regulations.

If you do not have a will, the state can determine exactly how to split your properties among your successors, which might not be according to your desires. An estate preparation attorney can help arrange all your legal papers and distribute your assets as you wish, possibly preventing probate.

Rumored Buzz on Estate Planning Attorney

When a customer dies, an estate strategy would determine the dispersal of properties per the deceased's instructions. Estate Planning Attorney. Without an estate strategy, these decisions may be delegated the next of kin or the state. Tasks of estate coordinators consist of: Producing a last will and testimony Establishing trust fund accounts Naming an executor and power of attorneys Determining all beneficiaries Naming a guardian for small youngsters Paying all financial obligations and decreasing all tax obligations and legal costs Crafting directions for passing your values Establishing choices for funeral plans Finalizing instructions for treatment if you end up being unwell and are incapable to choose Acquiring life insurance, disability income insurance coverage, and lasting care insurance A good estate strategy need to be upgraded frequently as customers' financial situations, individual motivations, and government and state legislations all develop

Just like any type of career, there are qualities and abilities that can assist you accomplish these goals as you deal with your clients in an estate planner duty. An estate planning profession can be ideal for you if you possess the adhering to traits: Being an estate coordinator suggests thinking in the long term.

Get This Report about Estate Planning Attorney

You need to aid your client anticipate his/her end of life and what will certainly take place postmortem, while at the very same time not dwelling on somber thoughts or feelings. Some customers may become bitter or anxious when pondering death and it can drop to you to help them through it.

In the occasion of fatality, you may be expected to have numerous discussions and ventures with surviving member of the family about the estate plan. In order to stand out as an estate organizer, you may require to stroll a great line of being a shoulder to lean on and the individual depended on to interact estate planning issues in a prompt and professional manner.

tax obligation code changed thousands of times in the one decade between 2001 and 2012. Anticipate that it has been modified better ever since. Depending upon your customer's monetary revenue brace, which may develop towards end-of-life, you as look at this now an estate planner will have to maintain your client's properties in full lawful compliance with any local, federal, or international tax obligation legislations.

Little Known Questions About Estate Planning Attorney.

Getting this qualification from companies like the National Institute of Licensed Estate Planners, Inc. can be a solid differentiator. check my source Being a member of these expert teams can verify your abilities, making you a lot more eye-catching in the eyes of a prospective client. Along with the emotional reward helpful clients with end-of-life planning, estate planners enjoy the advantages of a steady income.

Estate preparation is an intelligent thing to do regardless of your current health and wellness and economic condition. The very first essential point is to hire an estate planning lawyer to aid you with it.

The percentage of people that do not understand exactly how to obtain a will has raised from 4% to 7.6% given that 2017. A knowledgeable lawyer knows what info to include in the will, including your beneficiaries and special considerations. A will certainly shields your household from loss as a result of immaturity or incompetency. It additionally gives the swiftest and most efficient method to move your possessions to your beneficiaries.

Report this page